In the ever-evolving landscape of modern accounting, collaboration, and efficiency have become the bedrock of success. Moreover, as we wholeheartedly embrace the digital era, the demand for cutting-edge accounting collaboration tools has surged to unprecedented levels.

Today, we invite you to embark on a compelling exploration of the Best Accounting Collaboration Tool of the Year 2023. Together, let us get ready to be captivated as we delve into the top contenders. Each of these tools wields a unique arsenal of features and functionalities, promising to revolutionize the way accounting professionals collaborate, communicate, and streamline their financial processes.

So, without further ado, let us embark on this immersive journey as we unveil the remarkable tools that have rightfully earned their place at the forefront of accounting innovation. These tools are setting a new standard for efficiency, accuracy, and seamless collaboration in the dynamic realm of finance.

Advantages of Accounting Collaboration Tools

When it comes to accounting collaboration tools, the advantages are abundant, promising a transformative shift in the way financial professionals work together. Furthermore, let’s delve into the remarkable advantages these tools bring to the table:

Enhanced Time Efficiency:

First and foremost, accounting collaboration tools offer enhanced time efficiency. Additionally, through the automation features embedded within these tools, tasks such as creating journal entries and reconciling statements are streamlined, thereby freeing up valuable time for accounting professionals to focus on more strategic endeavors.

Seamless Compliance Support

Furthermore, these tools provide seamless compliance support. Many accounting software programs offer robust features that assist businesses in maintaining compliance with tax regulations and reporting requirements. By simplifying complex compliance procedures, these tools alleviate the burden on accounting professionals, ensuring businesses stay on top of their financial obligations.

Ease of Accessibility

With the advent of cloud-based solutions, accounting professionals can securely access their accounts and collaborate with team members from anywhere, at any time. This level of flexibility and mobility fosters increased productivity and efficient communication.

Streamlined Integration

Moreover, the streamlined integration capabilities of accounting collaboration tools are truly noteworthy. These tools seamlessly integrate with other essential business applications, such as customer relationship management (CRM) systems and e-commerce platforms. By facilitating the harmonious flow of information between systems, data silos are eliminated, and overall efficiency is enhanced.

Error Minimization

Another significant advantage is the reduction of errors. Moreover, by automating repetitive tasks and providing real-time insights, accounting collaboration tools effectively minimize the risk of human error. Consequently, this ensures accuracy in financial records and empowers accounting teams to make informed decisions based on reliable data. As a result, improved financial outcomes can be achieved.

Cost-Effectiveness

Additionally, accounting collaboration tools offer a cost-effective solution. Notably, they provide businesses with an affordable alternative to hiring an accountant. As a result, businesses of all sizes can efficiently manage their finances without incurring substantial overhead expenses. This accessibility makes these tools an attractive proposition, particularly for budget-conscious organizations.

Impeccable Organization

Last but not least, accounting collaboration tools excel in maintaining impeccable organization of financial records and transactions. By acting as centralized repositories, these tools facilitate the systematic organization of financial data. Consequently, this ensures easy access to vital information and simplifies the auditing and reporting processes. As a result, accounting professionals can experience peace of mind and improved efficiency in their tasks.

Types of Accounting Collaboration Tools

When it comes to accounting collaboration tools, there is a diverse range of options available, each catering to specific business requirements. Let’s explore the various types of accounting collaboration tools and their unique features:

Cloud-based

Firstly, we have the notable option of cloud-based accounting collaboration software. Moreover, with its flexible and scalable nature, cloud-based accounting collaboration software has emerged as a popular choice for businesses. Not only does it offer a cost-effective solution, but it also provides easy access to financial data, maintaining the efficiency and convenience desired by organizations.

On-premises

On the other hand, we have on-premises accounting collaboration software. In contrast to cloud-based solutions, businesses choose to install and maintain this software on their own servers. Although on-premises software may be comparatively more expensive, it provides greater control and customization options tailored to specific organizational needs. However, it is important to note that on-premises software requires dedicated resources for setup and ongoing maintenance.

Enterprise based

Another remarkable category is enterprise-based accounting collaboration software. Specifically tailored to meet the intricate requirements of big businesses, this software offers advanced features, extensive customization options, and robust scalability. While it may come with a higher price tag, enterprise accounting collaboration software empowers organizations to effectively manage their financial operations on a large scale, supporting their unique needs and fostering growth.

Small business

Furthermore, we have software specifically designed for small businesses. This type of software is user-friendly and cost-effective, offering essential accounting functionalities without overwhelming features. It provides a streamlined solution for small business owners to efficiently manage their financial records and collaborate effectively with their teams.

Open source

Moreover, for those seeking flexibility and customization, open source accounting collaboration software emerges as an appealing option. Notably, open source software, often available for free, empowers businesses to modify and adapt the software to suit their unique requirements. However, it is important to note that utilizing open source software may require more technical expertise for its setup and effective use.

ERP

Furthermore, next we have ERP (Enterprise Resource Planning) accounting collaboration software. Especially, this type of software seamlessly integrates with other essential business applications, such as customer relationship management (CRM) and e-commerce platforms, offering a comprehensive view of the organization’s financial data. While ERP accounting collaboration software provides enhanced connectivity and data synchronization, it is important to acknowledge that its setup and full utilization can be more complex.

Commercial

Moreover, we have commercial accounting collaboration software, which is a versatile option suitable for businesses of all sizes. Notably, this software is available in both cloud-based and on-premises versions, offering a comprehensive set of features and functionalities. The purpose is to facilitate accounting collaboration and streamline financial processes efficiently.

Industry-specific

Lastly, we have industry-specific accounting collaboration software, which caters to businesses in specific sectors such as construction, manufacturing, or retail. Notably, this software is specifically designed with industry-specific requirements in mind, offering tailored features to address the unique challenges faced by businesses in those sectors.

List of the Top Accounting Collaboration Software Available in 2023:

Here is our curated list that showcases the leading accounting collaboration software options available in 2023, enabling you to enhance collaboration, streamline workflows, and achieve financial excellence.

1. Quickbooks:

When it comes to cloud accounting software, QuickBooks stands out as a reliable and feature-rich solution catering to a wide range of businesses, from self-employed individuals to small and mid-sized enterprises. With its user-friendly interface and industry-specific capabilities, QuickBooks has earned a reputation as a trusted ally for efficient financial management. Let’s explore the key features that make QuickBooks a popular choice among businesses of various sizes and industries.

Key features

- Accuracy in reporting is essential for effective financial management, and QuickBooks excels in this area. The software offers robust reporting tools that allow users to generate estimates, reports, and insights effortlessly.

- Experience hassle-free cash flow management with QuickBooks’ streamlined bill organization and integrated app synchronization. Say goodbye to manual invoicing tasks as QuickBooks automates the process, saving you valuable time and effort.

- Simplify your payroll management with same-day direct deposits, ensuring accurate and timely payments for your employees. QuickBooks also offers additional services like live bookkeeping, point of sale, and time tracking, providing comprehensive solutions to meet your business requirements.

- Another noteworthy feature of QuickBooks is its inventory calculator and automatic GPS mileage tracking. This functionality enables businesses to manage their inventory efficiently and accurately track mileage for reimbursement or tax purposes.

- Tax compliance is a critical aspect of financial management, and QuickBooks understands this. The software allows users to categorize sales tax and avoid tax deductions, ensuring businesses remain compliant with tax regulations.

- QuickBooks also provides seamless integration of information to build customer profiles, allowing businesses to gain valuable insights into customer behavior and preferences.

- For businesses with global transactions, QuickBooks offers advanced support for multi-currency transactions. This feature simplifies the recording of international transactions and helps maintain accurate financial records across different currencies.

Pricing:

Choose from flexible pricing plans tailored to your business needs, ranging from $30/month to $200/month. QuickBooks also offers a Self-Employed/Independent Contractor Plan priced at $15/month. Experience the power of QuickBooks with a 30-day free trial and enjoy a 50% discount on your subscription for the first three months.

2. NetSuite

Experience the pinnacle of accounting efficiency with NetSuite, a cutting-edge cloud-based software that offers a comprehensive suite of ERP applications. From financial management, and inventory control to HR processes, and omnichannel commerce, NetSuite revolutionize accounting by consolidating all essential functions into one integrated platform. This powerful software is meticulously crafted to cater to a diverse range of businesses, including startups, rapidly growing enterprises, and PE- or VC-backed ventures.

Key Features

- NetSuite’s crown jewel lies in its ability to provide a panoramic 360-degree view of your cash management, empowering you to optimize your financial resources with precision. Gain real-time insights and make informed decisions to maximize cash flow, mitigate risks, and drive your business forward.

- Supercharge your accounts receivable with NetSuite’s advanced tools, designed to accelerate processes and enhance collection efficiency.

- Simplify your accounts payable management with NetSuite, avoiding late fees and saving valuable time. With its streamlined workflows, NetSuite enables you to effortlessly handle invoice creation, payment schedules, and overall transactional efficiency.

- Take control of your local and global tax management with NetSuite., ensuring compliance with regulatory standards and minimizing risks.

- NetSuite’s fully integrated fixed assets solution simplifies the management and tracking of your company’s assets. From streamlined asset tracking to accurate depreciation calculations, it empowers you to optimize asset management, ensuring accuracy and compliance.

- Leverage automation to streamline collection processes with NetSuite’s advanced collections management tools. It helps you gain valuable insights into customer payment history, and implement effective strategies to enhance cash flow.

Pricing

When it comes to pricing, NetSuite offers customized quotes tailored to your specific business needs. This ensures that you receive a pricing plan that aligns perfectly with your requirements, delivering optimal value for your investment.

3. Sage Intacct

Discover the power of Sage Intacct, a leading cloud-based financial software that has established itself as a global frontrunner. Beyond its exceptional accounting and ERP capabilities, Sage Intacct goes above and beyond by offering planning, analytics, and comprehensive HR and payroll services to clients of all types. With a wide range of utilities and a commitment to innovation, Sage Intacct continues to redefine financial software excellence.

Key Features

- Experience unrivaled efficiency as Sage Intacct automates and streamlines key finance processes through its powerful Advanced Functionality. Bid farewell to laborious manual tasks and embrace a streamlined accounts payable processing workflow that maximizes efficiency.

- Elevate your cash management and sales order fulfillment cycles with Sage Intacct’s intuitive features. It streamlines processes that enhance cash flow management and expedite transactions, ensuring optimal financial performance

- Streamline your general ledger tasks with ease and precision, thanks to the revolutionary Intelligent GL™. Sage Intacct’s advanced AI-powered solution simplifies the complexity of managing your financial records, allowing for enhanced efficiency and unparalleled accuracy.

- Stay ahead of evolving tax regulations and effortlessly manage tax obligations with Sage Intacct Multi-tax, enabling your business remains fully compliant at all times.

- Maintain optimal stock levels and gain unprecedented control over your inventory management through Sage Intacct’s robust module. Access real-time visibility into stock levels, streamline replenishment processes and ensure seamless inventory control that aligns with your business goals.

- Maximize revenue recognition efficiency while minimizing errors with Sage Intacct’s innovative tools, empowering your business with unmatched precision.

- Effortlessly monitor billable hours and manage expenses with the robust time and expense management features offered by Sage Intacct.

Pricing

Sage Intacct understands that pricing plays a crucial role in your decision-making process. That’s why they offer personalized quotes that are tailored to your business size, industry, and unique requirements to achieve long-term success.

4. TeamingWay

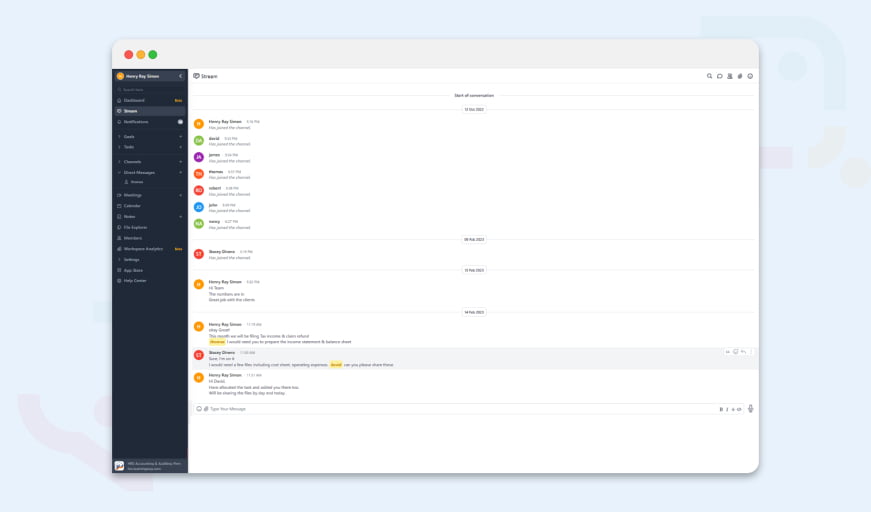

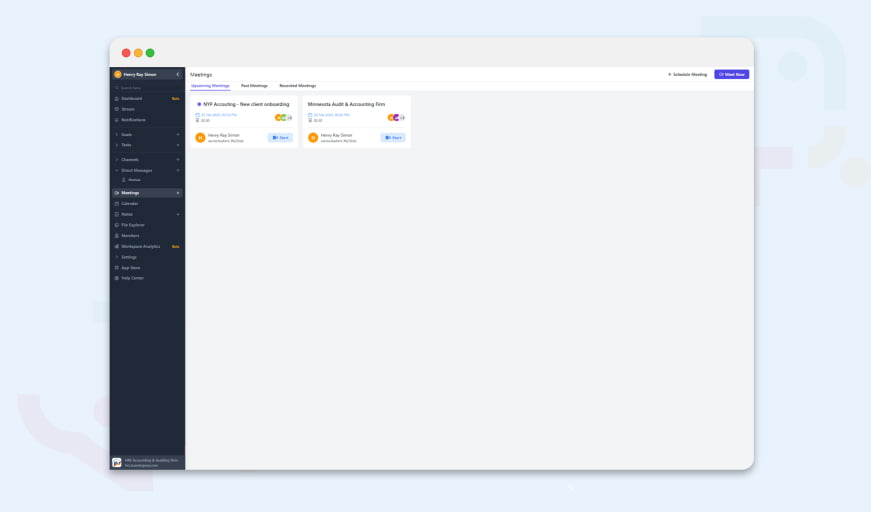

Revolutionize your accounting collaboration with TeamingWay, an innovative platform designed to elevate teamwork and efficiency to new heights. In the fast-paced world of accounting, where collaboration and streamlined communication are paramount, TeamingWay emerges as a game-changer. With its intuitive interface, powerful features, and seamless integration capabilities, TeamingWay empowers accounting professionals to collaborate effortlessly and optimize their workflows.

Key Features

- TeamingWay serves as a centralized hub, bringing together accounting teams and facilitating real-time collaboration. Whether it’s sharing files, assigning tasks, or coordinating efforts, TeamingWay provides a user-friendly environment where every team member can stay connected and work together seamlessly.

- Document management has never been easier. With TeamingWay, say goodbye to stacks of paperwork and embrace a secure, digital ecosystem where documents can be uploaded, shared, and collaborated on with ease. The platform’s advanced permission settings and version control features ensure that everyone has access to the latest information, eliminating confusion and enhancing productivity.

- Unlock the power of data-driven decision-making with TeamingWay’s robust reporting and analytics capabilities. Gain real-time insights into your financial data through customizable reports and interactive dashboards. TeamingWay empowers you to make informed decisions confidently, enabling you to stay ahead of the curve and drive your business forward.

- The platform prioritizes data privacy and implements robust security protocols, including encryption, and regular backups. With TeamingWay, you can focus on collaborating effectively, knowing that your data is safe and accessible only to authorized users.

- TeamingWay understands that collaboration doesn’t happen in isolation. That’s why it offers seamless integration with other popular accounting software, enabling smooth data transfer and synchronization.

Pricing

TeamingWay’s pricing structure is designed to provide flexibility, scalability, and transparency, enabling you to optimize your collaboration capabilities without straining your budget.

By offering tailored pricing plans and the potential for trial periods or promotional offers, TeamingWay demonstrates its commitment to delivering exceptional value and ensuring customer success.

5. Xero

Experience the transformative power of Xero, a renowned accounting software solution embraced by small businesses, accountants, and bookkeepers worldwide. With its unrivaled capabilities, Xero simplifies and streamlines everyday business operations, empowering users to automate laborious tasks, maintain accurate records, and foster seamless collaboration. The platform seamlessly integrates with over 1,000 third-party apps, catering to the specific needs of diverse industries, including retail, construction, Amazon sellers, and nonprofits.

Key Features

- Gain invaluable insights into your business’s financial performance with Xero’s robust reporting capabilities. Generate detailed reports in multiple currencies to make informed decisions that drive growth.

- Simplify and streamline your bill management process with automated scheduling and online payment capabilities, saving you time and reducing the risk of errors.

- Embrace a paperless approach with Xero’s automated expense management tools. Generate sales tax returns and expense reports effortlessly, ensuring accurate record-keeping and compliance.

- Monitor your cash flow in real time with Xero’s secure bank feeds. Connect your bank accounts and credit cards to Xero, and transactions will be automatically imported and categorized. Stay on top of your finances, spot discrepancies, and make informed financial decisions with ease.

- Streamline your transaction categorization process with Xero’s intuitive bulk categorization feature. Spend less time on manual data entry and focus on what matters most – growing your business.

- Safely store and manage employee data within Xero’s secure platform. Access essential HR tools, including employee profiles, time off tracking, and payroll information. Simplify payroll processing with seamless integration and ensure compliance with tax regulations.

- Tailor reports to suit your unique business needs. Gain deep insights into inventory management, track purchase orders, and optimize your supply chain effortlessly.

Pricing

Xero offers flexible pricing plans designed to cater to businesses of all sizes. The Starter Plan, priced at $25/month, provides essential features for small businesses. The Standard Plan, available at $40/month, offers expanded functionality for growing enterprises. For businesses seeking advanced features and scalability, the Premium Plan is available at $54/month.

6. FreshBooks

Embark on a transformative experience with FreshBooks, an exceptional accounting solution meticulously designed for independent contractors, budding entrepreneurs, and rapidly expanding enterprises. Crafted by a passionate team of experts who understand the unique challenges faced by small business owners, FreshBooks is committed to simplifying accounting and providing you with the tools you need to thrive. With its user-friendly interface, on-the-go accessibility, and powerful features, FreshBooks is your trusted ally in managing your finances with ease and precision.

Key Features

- FreshBooks automates payment collection and recording, allowing you to effortlessly receive payments directly from clients. Save time and improve cash flow management with seamless automation.

- Keep a close eye on your expenses and receipts with FreshBooks’ intuitive expense tracking module. Capture expenses on the go, categorize them effortlessly and gain valuable insights into your spending habits.

- Enhance productivity and collaboration with your clients through FreshBooks’ easy-to-use client portal. Share project updates, exchange messages, and provide access to important documents, ensuring smooth communication and fostering strong client relationships.

- Capture billable hours and track mileage with ease using FreshBooks’ time tracking and mileage logging features. Automatically record and invoice for your valuable time and accurately track reimbursable mileage, eliminating manual calculations and increasing efficiency.

- Seamlessly integrate your FreshBooks accounts with Bench, a trusted bookkeeping service. Simplify your bookkeeping processes and ensure accurate financial records, all while leveraging the expertise of professional bookkeepers.

- Take advantage of FreshBooks’ integration with popular payroll platforms like Gusto. Streamline your payroll processes, calculate employee wages accurately, and ensure compliance with payroll regulations effortlessly.

Pricing:

FreshBooks offers flexible subscription plans based on the number of billable clients per month. Choose the plan that best suits your business needs, with pricing ranging from $15/month to $55/month. For businesses requiring more advanced features, FreshBooks also offers a custom plan. Take advantage of the free 30-day trial to explore FreshBooks’ robust features and experience its benefits firsthand.

Conclusion

In conclusion, now is the time to revolutionize your accounting practices by embracing the unparalleled transformative power of collaboration tools. By seizing the extraordinary opportunity that lies before you, you can embark on a journey to make 2023 the year that sets remarkable new standards in financial management.

Moreover, it is important to remember that success favors those who dare to innovate. By embracing the future and reimagining your financial journey, you will witness the remarkable impact that the best collaboration tool of the year 2023 can have on your business.

Therefore, your journey to financial excellence starts now!